For experienced hosts, VRBO’s fee structure can significantly impact your bottom line. Understanding VRBO host fees and the VRBO host fee structure is crucial for anyone operating a vacation rental business, as these costs directly affect your pricing strategy and overall profitability. Staying informed about upcoming changes allows you to adjust your strategies and maintain profitability. In 2025, VRBO is introducing fee adjustments and updates aimed at aligning with broader industry trends and regulatory pressures. This breakdown offers a deep dive into these changes, their implications, and strategies for maintaining profitability as a VRBO host, highlighting how VRBO hosts can benefit from staying informed about these changes.

The Current Fee Structure: A Refresher

Pay-per-Booking (PPB)

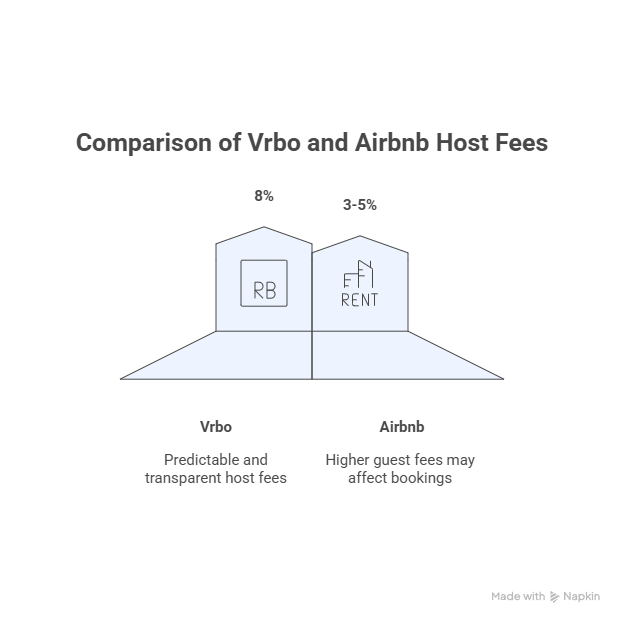

This model charges a 5% commission, also referred to as a pay per booking fee or booking fee, on the total rental amount, including rent, cleaning fees, and additional guest fees. Pay per booking fees are charged for each confirmed reservation. Both the commission and the 3 payment processing fee are calculated based on the total payment amount or total payment received from the guest, which includes rental fees, taxes, and refundable deposits. Additionally, a 3% credit card processing fee, known as a 3 payment processing fee, applies to all bookings. The pay-per-booking fee model charges a total of 8%, which includes the 3% payment processing fee and a 5% commission fee. This structure ensures that hosts only pay fees proportional to their bookings.

The pay-per-booking model is ideal for hosts with unpredictable booking volumes or those just entering the market. It allows for flexibility without requiring an upfront financial commitment. For properties that are booked less often or only during peak seasons, the pay-per-booking fee model might be a better choice. For hosts earning less than $10,000 per year, this option can be particularly advantageous as it incurs no upfront cost.

Subscription Model

The annual subscription is an annual fee of $699 paid upfront, providing unlimited bookings without the 5% commission. However, the 3% credit card processing fee still applies. This subscription fee offers a predictable cost structure for hosts with frequent bookings.

This model is ideal for properties that are booked frequently or have a high booking frequency, as it can be more cost-effective than paying per booking. It benefits established hosts with consistent bookings exceeding $10,000 annually. The annual fee eliminates per-booking commissions, simplifies expense tracking, and offers predictability in costs. Additionally, reservation management tools are included as part of the subscription package, streamlining scheduling and property management for hosts. The subscription fee model allows hosts to keep 100% of their booking revenue, excluding payment processing fees. High-performing listings on VRBO may benefit more from this model compared to the pay-per-booking model.

These two options have made VRBO attractive to a diverse range of hosts, allowing flexibility based on individual business models. Hosts should assess their booking frequency to determine which fee structure is more cost-effective for them. Regularly monitoring booking patterns can help hosts make informed decisions about which model aligns best with their financial goals.

What’s Changing in 2025?

VRBO’s upcoming adjustments reflect the growing complexity of running a vacation rental platform. As the vacation rental market evolves, VRBO offers new features and fee structures to help hosts stay competitive and meet guest expectations. These changes mean that VRBO charges and VRBO’s fees are being updated, which may result in higher fees for some hosts. Here’s what hosts can expect:

Increased Credit Card Processing Fees

The credit card processing fee, also known as the payment processing fee charged to hosts, is rising from 3% to 3.5%, a move attributed to higher payment processor costs. Payment processing fees are a standard expense that hosts pay for each guest transaction, and these fees can directly impact your overall rental income. While this change may seem minor, it becomes significant for high-volume hosts.pending on your booking volume and business goals. By understanding how these fees work, hosts can better manage their properties, optimize their listings, and ensure their vacation rentals remain competitive in the market.

A host processing $100,000 in bookings will see an additional $500 in payment processing fees annually, further affecting the rental income that hosts pay attention to when managing their vacation rental business.

Modifications to the Pay-per-Booking Model

The base 5% commission remains unchanged, but new surcharges may be introduced for premium features. These surcharges could be classified as additional fees or custom fees, depending on whether they are optional or unique to your property, such as enhanced search placement during high-demand periods or specific promotions for your property. Some surcharges may also be considered mandatory fees if required for certain services. These changes may impact the overall fee model and fee models available to hosts, so it’s important to review how standard fees, additional fees, and custom fees are structured under the new system.

Subscription Model Enhancements

While the $499 subscription fee stays the same, VRBO may introduce tiered pricing. Higher tiers could offer advanced analytics, prioritized customer support, marketing tools, access to international sites for expanded global reach, and integration with property management software to streamline reservations and potentially reduce booking fees. Hosts with multiple properties may find these upgrades advantageous.

Regulatory Processing Fees

As cities and municipalities enforce stricter regulations, VRBO is passing compliance costs to hosts. These regulatory processing fees may include taxes and refundable damage deposits, so it is important to understand how the total amount charged to guests is calculated. The fees can apply to the entire payment, including the damage deposit portion, and hosts should be aware that processing fees on refundable damage deposits may be reimbursed when those deposits are refunded to guests. The exact amount varies by location, but hosts should anticipate this line item appearing more frequently. Additionally, having clear security deposit policies in your listing is essential to balance guest deterrence and property protection, and new regulations may affect how the damage deposit portion is handled.

The Impact on Hosts

Smaller Margins

Rising credit card fees, increased service fees, and higher Vrbo service fees all contribute to a higher overall booking cost, resulting in reduced profitability for hosts reliant on volume over premium pricing. The service fee, typically calculated as a percentage of the reservation amount, is charged to guests and covers platform maintenance; this fee, along with other service fees, directly impacts your margins if rates are not adjusted. Without adjusting rates, these changes could eat into your margins.

Greater Appeal of Subscription Models

For high-volume hosts, the subscription model’s flat-rate structure will likely become more attractive. When paired with potential perks like marketing tools or analytics, the value proposition of this model strengthens. Additionally, offering discounts for longer stays can help maximize the value of the annual fee and attract more bookings under the subscription model.

Increased Guest Pushback

VRBO’s fees are often passed to guests, contributing to higher total booking costs. This can result in resistance or cancellations, particularly when guests compare VRBO to platforms with lower perceived fees. To manage guest expectations and reduce pushback, it is important to clearly communicate all charges, including pet fees, in your listing. Note that guest service fees are calculated as a percentage of the reservation cost, excluding taxes and refundable charges, to ensure transparency. Hosts will need to justify their pricing through superior value or unique experiences.

Strategies to Offset Rising Fees

To stay competitive, hosts need a strong pricing strategy for their short term rental business or rental business. Proactive strategies include regularly reviewing and adjusting your nightly rate to reflect changes in platform fees, cleaning costs, and other expenses. Optimizing your nightly rate based on seasonal demand ensures you maximize revenue during peak periods and remain attractive to guests during slower times.

Adjust Pricing Thoughtfully

Small pricing adjustments can help cover rising fees without deterring guests. Rather than applying blanket increases, analyze your bookings and consider reviewing your pricing strategy, including pet fees, additional fees, standard fees, and any custom fees. Ensuring these charges are competitive and transparent can help maintain guest trust and optimize your overall profitability. Consider:

Raising nightly rates by a small percentage.

Revisiting cleaning fees to ensure they reflect market rates.

For properties in high-demand areas, premium pricing during peak seasons can offset lower rates in quieter periods.

When building a direct booking pipeline, hosts may need to set up their own payment provider to process guest payments. Choosing a reliable payment provider is essential for handling payouts and ensuring secure transactions, which helps build trust and protects both hosts and guests.

Explore Direct Booking Options

With rising platform fees, diversifying your channels is crucial. Building a direct booking pipeline through your own website or social media presence reduces reliance on platforms like VRBO. Offer incentives to repeat guests who book directly, such as discounts or added perks.

Optimize Operational Efficiency

Conduct regular audits of your operating expenses. Review contracts with cleaning services, landscaping providers, and maintenance vendors to find cost savings. Additionally, invest in tools that streamline operations, such as smart locks and energy-efficient appliances.

Test VRBO’s Premium Features

If VRBO introduces pay-to-promote features, evaluate their effectiveness by testing them during off-peak periods. Track key metrics such as visibility, conversion rates, and overall ROI. Avoid overcommitting until you’re confident these features deliver measurable benefits.

Advanced Tactics for 2025

Experienced hosts can take advantage of these tactics to navigate the changing fee landscape effectively. By diversifying their listings across multiple platforms, hosts can tap into the broader vacation rentals market and stay competitive as the vacation rental industry evolves. Additionally, offering trip cancellation protection as an optional benefit can attract more guests by providing extra peace of mind in case unforeseen circumstances force them to cancel their trip.

Leverage Regional Knowledge

Hosts in areas with high regulatory fees can differentiate their listings by emphasizing unique amenities or personalized service. For instance, offering local experiences like guided tours or curated recommendations can create value that outweighs higher costs.

Invest in Guest Retention

Repeat guests are less sensitive to price fluctuations, as they already trust your property and service. Consider developing a loyalty program or offering exclusive discounts for returning customers. High-quality communication, personalized check-ins, and thoughtful touches can also foster long-term loyalty.

Diversify Your Listings

If rising fees on VRBO impact profitability, evaluate alternative platforms. Sites like Airbnb, Booking.com, or niche platforms tailored to specific demographics may offer more favorable fee structures or unique audiences.

Use Analytics to Drive Decisions

Leverage data to understand which bookings yield the highest returns. Tools that integrate with VRBO can provide insights into guest demographics, seasonal trends, and competitive pricing. Use this information to tailor your pricing and marketing strategies for maximum profitability.

Hidden Opportunities

While fee increases can be frustrating, they also present opportunities for strategic growth. For example, hosts in the vacation rental market can maximize profitability and safeguard their rental income by opting for property damage protection, which covers damages caused by guests and provides financial security beyond traditional security deposits.

Better Understanding Your Costs

These changes force hosts to scrutinize their expenses. A thorough understanding of your cost structure enables better decision-making and long-term financial health.

Opportunity to Stand Out

As some hosts struggle with rising fees, those who can effectively absorb or justify their pricing will have a competitive advantage. Properties with stellar reviews, unique features, or high guest satisfaction will remain desirable regardless of fees.

Focus on Quality Over Quantity

Rather than chasing volume, prioritize bookings with higher profit margins. This may mean targeting a specific type of guest, such as families, corporate travelers, or long-term renters, who are less price-sensitive.

Practical Examples

Here’s how these strategies can work in real-world scenarios:

When calculating fees, the total payment received by the host includes the rental amount, taxes, security deposits, and the guest’s deposit (such as refundable damage deposits). For example, if a guest pays $1,000 for a stay, with $100 as a refundable damage deposit and $50 in taxes, the total payment is $1,150. Payment processing fees and commissions are typically calculated on this total payment, including the guest’s deposit and security deposits. Taxes and refundable damage deposits are included in the total amount charged to the guest, but certain fees may not apply to taxes and refundable damage portions.

If the refundable damage deposit is returned to the guest after their stay, the processing fee on that refunded amount is also reimbursed to the host. This ensures that hosts are not charged processing fees on refundable amounts, such as the guest’s deposit, when it is returned.

Scenario: Rising Credit Card Fees

A host who processes $50,000 in bookings annually would pay $1,750 in credit card fees at 3.5%, up from $1,500. By increasing nightly rates by just 2%, they can cover the difference without alienating guests.

Scenario: Subscription Model Benefits

A host with $25,000 in annual bookings would save $750 in commissions under the subscription model versus pay-per-booking. Using those savings, they could reinvest in paid promotions or property upgrades.

Scenario: Regulatory Compliance Fees

A host in a city with a $200 licensing fee could offset the cost by marketing their property’s unique compliance advantages, such as contributing to community initiatives or adhering to sustainability standards.

Conclusion

Navigating VRBO’s updated fee structure in 2025 requires careful planning and adaptability. Hosts who actively monitor these changes, adjust their strategies, and leverage available tools will be better positioned to succeed. By focusing on efficiency, exploring new revenue channels, and prioritizing guest satisfaction, you can mitigate rising fees and even find opportunities for growth. Stay informed, stay proactive, and keep delivering value to your guests—that’s the key to thriving as a VRBO host in the year ahead

The post Breaking Down the VRBO Host Fees on VRBO: What to Expect in 2026 appeared first on 10XBNB.

source https://learn.10xbnb.com/host-fees-on-vrbo/